Press Release

Polling by the Institute for Health Policy’s Sri Lanka Opinion Tracker Survey (SLOTS) reveals a significant disconnect between Sri Lankan voters and political leaders regarding personal income tax rates. While all major parties have proposed reductions in PAYE (Pay-As-You-Earn) taxes for high-income earners, SLOTS data from August to November 2024 shows that a majority of Sri Lankans would support increasing taxes on top earners.

1. Despite the attention given by politicians to reducing PAYE taxes, SLOTS polling since November 2023 found that most Sri Lankans don’t view high taxes as a top problem facing the country, nor it being an important issue in deciding who to vote for.

Despite political attention to reducing PAYE taxes, few Sri Lankans see high taxes as a pressing national issue. In SLOTS polling conducted from August to November 2024, just 14% mentioned high taxes among the top two issues facing the country, a figure that has declined through 2024. Similarly, few voters consider it a major factor when deciding how to vote in the general election.

By comparison, two-thirds of Sri Lankans prioritize increased spending on health and education when informed of budget constraints.

2. NPP and better-off voters are more likely to cite high taxes as a top problem, but such voters are still a minority in both groups.

Higher-income respondents and supporters of the National People’s Power (NPP) party are more likely to see high taxes as a key issue, but even within these two groups, only 15–25% consider it a top concern, with interest declining in recent months.

3. Sri Lankans strongly support more progressive income tax with the rich paying more.

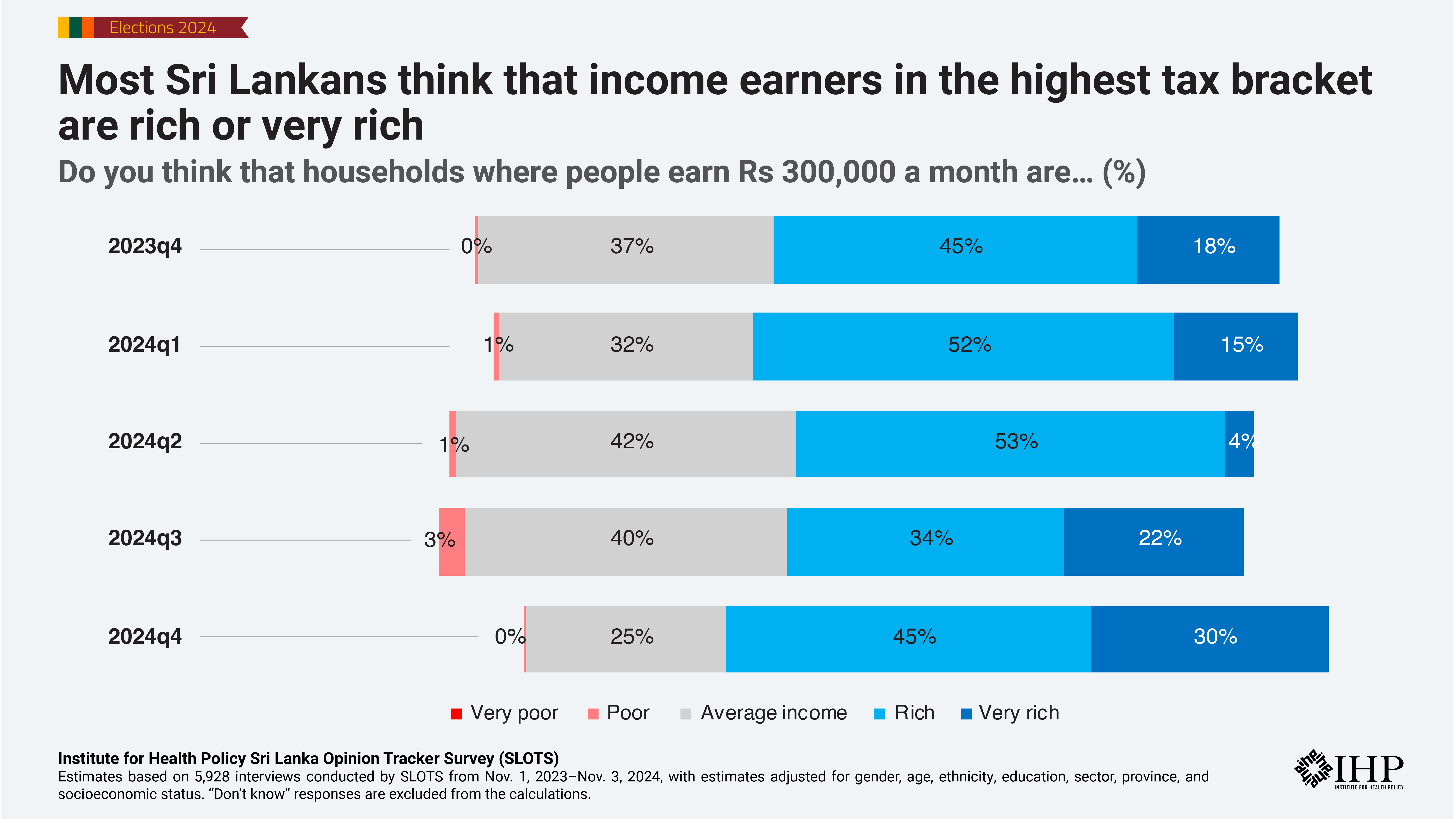

A large majority of Sri Lankans support progressive income tax, with higher rates for the wealthy. Most (66%) consider monthly earners of Rs 3 lakhs as "rich" or “very rich”, rising to 93% for monthly earners of Rs 5 lakhs.

Six in ten (59%) Sri Lankans prefer additional taxes to be distributed 5:1 between rich and poor. Amongst NPP supporters, this drops to four in ten (41%), with another 28% supporting a 2:1 distribution.

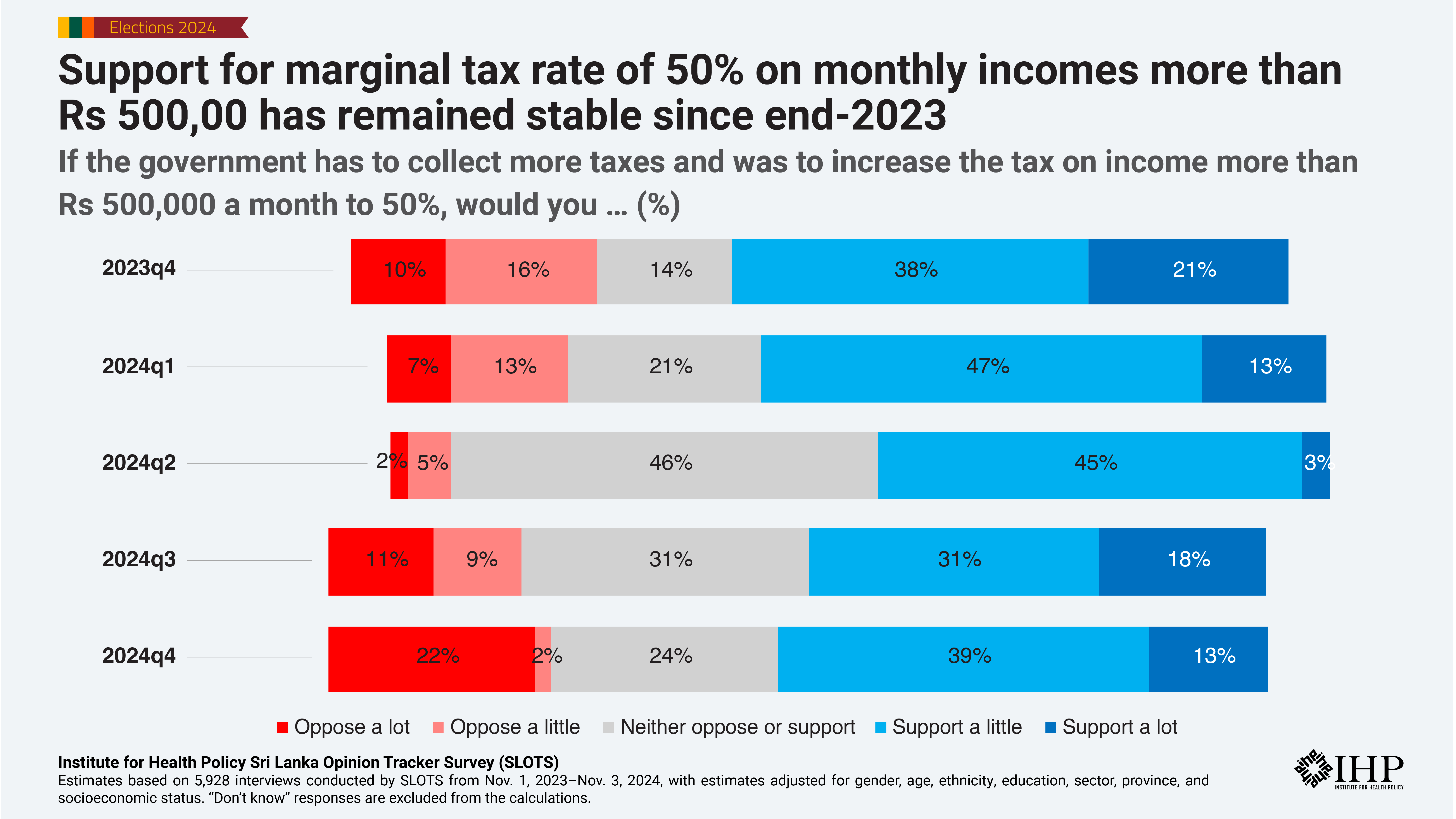

4. More voters support than oppose raising PAYE rates on high income earners to 50% if the government is short of money to pay for public services and to payback debt.

Sri Lankans support higher marginal income tax rates on high earners if the government needs to pay for debt or public services. In SLOTS polling since September 2024, 47% of adults support raising PAYE tax to 50% on monthly incomes more than Rs 5 lakhs versus 31% who oppose.

5. Few Sri Lankans pay PAYE tax, which may contribute to the disconnect between voters and politicians of all parties.

In SLOTS surveying during 2024, 2.2% of Sri Lankan adults say they pay PAYE income tax, consistent with numbers that the Tax Department have reported previously (243,000 PAYE tax files at end-2023 or roughly 1.5% of the adult population). At most, only 8% of Sri Lankans live in households where at least one member pays PAYE, indicating that most voters are unaffected by PAYE.

Dr. Ravi Rannan-Eliya, IHP Executive Director, commented that:

“Sri Lankans prioritize the benefits of higher taxes in the form of more spending on basic services, but political parties appear more aligned with higher-income groups. This disconnect isn’t unique to Sri Lanka; it mirrors trends in Europe and the United States, where elite concerns often diverge from public priorities. Sri Lanka’s growing income gap likely deepens this divide, with elites even more out of touch with broader public sentiment. Politicians might want to take note of recent elections in other countries which demonstrate what happens when elites ignore the needs of most voters.”

Dr. Rannan-Eliya added, “The Parliament we elect next week faces a daunting fiscal challenge. With substantial public debt and low investment in health and education—both of which voters prioritize—raising taxes on high earners aligns with public opinion. It would also be smart political strategy and might well help a new government rally support for raising taxes to support economic recovery by demonstrating fair sharing of the fiscal burden.”

About IHP

IHP is solely responsible for commissioning and designing the survey, and it takes full responsibility for it. IHP is an independent, non-partisan research institution based in Colombo, Sri Lanka. The SLOTS lead investigator is Dr Ravi Rannan-Eliya of IHP, who was trained in public opinion polling at Harvard University, and who has conducted many opinion surveys over three decades, both in and outside Sri Lanka.

Methodology

SLOTS surveys a national sample of adults (ages 18 and over) reached by random digit dialling of mobile numbers, and others coming from a national panel of respondents who were previously recruited through random selection. All estimates are weighted to match the national population with respect to age, sex, sector, ethnicity, religion, education, socioeconomic status, and province.

Funding

IHP conducts the SLOTS survey to track changes in health and social conditions, and public opinion in the country. IHP is solely responsible for conceiving, commissioning and designing the survey, and it takes full responsibility for it. Interviews are done daily by phone by IHP employees, with respondents recruited by a national field survey or by randomly dialling phone numbers. SLOTS fieldwork since 2021 has been supported by a range of funders, who play no role in question design, data analysis, or reporting. Past funders have included the Neelan Tiruchelvam Trust, Asia Foundation, European Commission, UK National Institute for Health and Care Research, the Foundation Open Society Institute, and others. Current fieldwork is supported by funding from the Velux Stiftung foundation, New York University Abu Dhabi, USAID, and the IHP Public Interest Research Fund. The survey findings and IHP reporting do not necessarily reflect the views or positions of past and present funders. Interested parties can contact IHP for more detailed data and results.

EMBARGOED UNTIL

Date: 11 November 2024

Time: 03:30 PM Sri Lanka Time

FOR FURTHER INFORMATION CONTACT

Secretary/Administrator

Email: info ‘at’ ihp.lk

TO CONTACT LEAD INVESTIGATOR

Dr. Ravi Rannan-Eliya

Email: ravi ‘at’ ihp.lk Twitter: @ravirannaneliya